Casino Feasibility Study

Initially, The Innovation Group provided a feasibility analysis for relocation of their temporary casino to a permanent location as well as a number of ancillary amenities such as golf course, gas station, convenience store and retail outlet. The next step is the feasibility study. Based on the designs, the developer will obtain construction and other project costs. The analyst who performs the feasibility study will test whether the expected revenues which were generated in the market analysis sufficiently exceed the expected costs. In most cases, the project is required to generate a. The feasibility study was the first step toward a Chicago casino as spelled out in the massive gambling expansion bill passed earlier this summer in Gov. Pritzker’s $45 billion capital plan. The governor’s office said they don’t expect the study’s findings to “significantly impact” the six-year plan.

- Casino Feasibility Study Questions

- Chicago Casino Feasibility Study

- Casino Feasibility Study Guides

- Casino Feasibility Study

- None of the five potential sites for a casino in Chicago are “financially feasible” due to the current tax and fee structure in place in the city, a $120,000 study by Union Gaming Analytics for the Illinois Gaming Board has concluded.

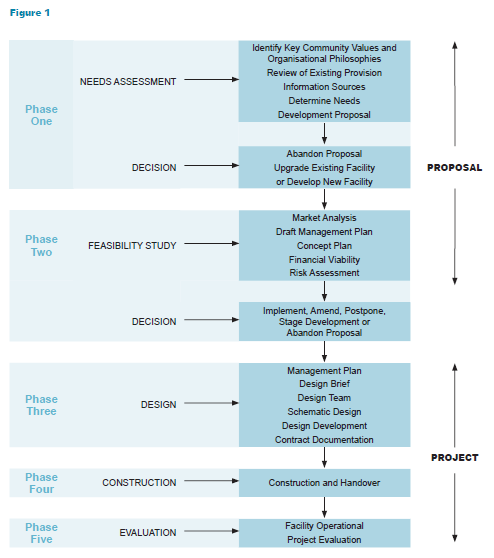

- Casino Feasibility Study We have quick, real-world solutions to minimise your investment risk, minimise cost and to get you off to a flying start. The phased sequencing of our casino planning process is designed to minimise overall project time and costs and provide clear decision points along the way.

None of the five potential sites for a casino in Chicago are “financially feasible” due to the current tax and fee structure in place in the city, a $120,000 study by Union Gaming Analytics for the Illinois Gaming Board has concluded.

The gaming expansion bill signed into law by Illinois Governor J.B. Pritzker in July allowed for the establishment of six new land-based casinos, including a major facility in Chicago. While such a facility could potentially become the highest-grossing casino in the state, the study said, high taxes would see it struggle to turn a profit.

The report released today (13 August) said the Chicago facility was not feasible because of a special privilege tax levied on the venue in return for the right to operate a casino in the city.

“We would also expect any such proposal to be dependent on either material changes to, or abatement of, the City of Chicago privilege tax of one third of adjusted gross receipts, and potentially the backwards-looking reconciliation fee,” the report said.

“While not all of the tax ‘savings’ would drop to the bottom line in the event the special privilege tax is rescinded, most of it would. In this scenario, and while the casino would certainly allocate some of the savings to, for example, increased marketing efforts, the lack of the special privilege tax would allow a casino to operate with margins broadly in line with the in-state peers.”

The five sites — four on the South side and one on the West side — were selected by the city of Chicago and visited by Union Gaming. The advisory firm reported that none of the sites were ideal, but ultimately ruled that regardless of location, the “the onerous tax and fee structure” in Chicago would be too large an obstacle to overcome.

“The current regulatory construct, namely the highest effective gaming tax and fee structure in the US makes any casino project – regardless of location – generally not financially feasible,” the study said.

According to the study, a casino in Chicago would have to pay a 39% tax on revenue in addition to a 33.3% privilege tax for operating in Chicago, culminating in an effective tax rate of 72%. Union Gaming examined the finances of other casinos in Illinois — which all reported earnings before interest, tax, depreciation and amortization between 19.2% and 26.7% — and in the rest of the US, concluding the privilege tax would be too much to make a Chicago casino profitable.

At the current tax rate, the study concluded that any Chicago casino make at best a 1-2% annual return, which the report stated would be too low a margin for any operator to conduct a successful business.

“We believe a reasonable casino developer would not move forward with a greenfield casino project that has, at best, a low single digit profit margin,” the study said.

The report added that even a casino structured to make a profit from non-gaming amenities would still be unlikely to make more than, “a few pennies on the dollar” and that a casino with these profit margins would be unlikely to obtaining financing.

The report did, however, state that a city-owned casino may be a possible solution.

The gaming expansion bill will also allow legal sports betting in Illinois, but the state gaming commission still needs to create a regulatory framework and a date for the first legal sports wagers remains unknown. Meanwhile, the neighbouring states of Iowa and Indiana are both set to have legal sports betting in place before the start of the NFL season. Among the casinos issued a temporary sports betting permit in Indiana is Ameristar Casino in East Chicago, located 5 miles from the Illinois border and 20 miles from downtown Chicago.

Related Articles

Casino Feasibility Study Questions

Illinois betting handle grows 42.4% in October

Chicago Casino Feasibility Study

Illinois’ sports betting market grew once again in October, with amounts wagered up 42.4% month-over-month to $434.6m, and revenue jumped to $42.2m as the vertical’s…

Casino Feasibility Study Guides

PA sets new sports and igaming revenue records in November

Pennsylvania broke its sports betting and online gambling revenue records in November, though declining land-based revenue led to a year-on-year drop in the state’s monthly…